Warren Buffett’s Principles of Long-Term Wealth Creation

Warren Buffett “the Oracle of Omaha, is worth over $146 billion (2015), money he made principally by investing in the stock market. His success has been the result of some guiding principles for long-term term investment which he has shared publicly in his many interviews. This blog captures some of these for you to learn from.

Warren Buffett has seen 14 United States presidents, witnessed 7 wars, and all sorts of devastating macro events. He is arguably the most renowned Investor alive. He is still the CEO of Berkshire Hathaway Inc., a company that has grown its wealth by 20 percent annually, compounding for over 5 decades.

Here are Warren Buffett’s Principles for Long-Term Wealth Creation:

1. By far, the best investment you can make is in yourself

The more knowledge and skills you possess, you more valuable you become. Whether it is taking courses, learning a skill, reading a book, cultivating good habits, attending a seminar, etc. the more of it you have, the more your value.

Investing in yourself pays off in the long term since some of those skills will help you make better judgments in investing.

“By far the best investment you can make is in yourself. If you invest in yourself, nobody can take it away from you” – Warren Buffett

When it comes to investing, he is very particular about learning accounting skills, because, it helps you properly access the fundamentals of a company. And to him, knowing the fundamentals is key to investing in any company.

Investing in yourself includes taking good care of your health. You can only make the money if you have good health to choose and manage the investments.

2. Make your first investment as early as possible

Warren Buffet, in an interview, mentioned he made his first investment in the spring of 1944 when he was just 11. That is not what most people will do at that age. This in part helped mold his character and general approach to investing.

It is said that making your first investment as early as possible puts you ahead of 97 percent of people. Even if what you start with initially may not be so much, the value of time and compounding interest can turn the investment into something unimaginable.

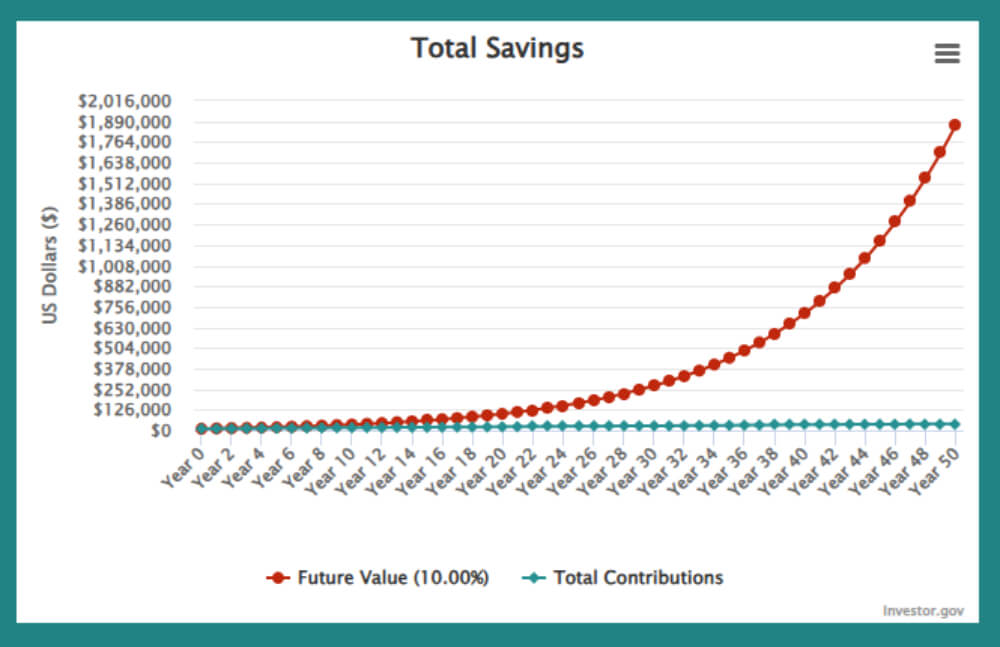

Here is what compound interest can do to your funds and the value of making your first investment as early as possible. A $10,000 investment in the S&P, with a monthly contribution of $50 over 50 years, at the average market return of 9 – 10 percent per annum will yield $1,872,253.65.

Here is a quote on Compound Interest that is often attributed to Albert Einstein

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it,”

Investing for a long period by starting early and compounding your interest is one of Warren Buffet’s -and indeed, much of Wallet Street – secrets to building wealth.

3. Understand the Fundamentals

For Warren Buffett, good investment doesn’t require constant maintenance. What you look at are the fundamentals and the long-term prospects of the company, so you don’t have to always check in every other day to see how the investment is doing.

When you lock in your investment, you take your mind off it. Let those running the company do the heavy lifting while you check in once in a while to see the progress.

“If you have to closely follow our company, you should own it” – Warren Buffett

If you have substantial doubt about your investment, maybe you haven’t done enough to understand the fundamentals of the company or you shouldn’t have made them in the first place. It can also be that you are not psychologically and emotionally ready to handle the investment. A good investment doesn’t require your constant eyeballs.

80 percent of Berkshire Hathaway’s portfolio -Warren Buffett’s company – is in only a handful of companies that they have been holding on to. Companies with good fundamentals. They don’t play the short game.

4. Don’t get hung up on trying to make an economic analysis

If you are trying to find the perfect entry price for your investment, you are probably planning for short-term gains, which in Warren Buffet’s books is a loser’s game. Check the fundamentals (as mentioned earlier) and go for the long haul.

Warren Buffett advice

“You don’t want to get hung up on trying to make economic analysis because nobody is good at that. You don’t get rich doing them (economic analysis)” – Warren Buffett

If are really doing the long term, you should not be worrying too much about picking the tops or the bottoms of the markets. Over time, the market is going to swing one way or the other on factors that are beyond anyone’s ability to predict.

Work with what you can control – i.e. pick stocks with good fundamentals long term. Warren understands that focusing on economic analysis can distract him from his long-term goals.

5. Invest in an index fund and never look at a headline

Index funds are investment funds that follow a benchmark index, such as the S&P 500 or the Nasdaq 100. When you invest in an index fund, it represents an investment into all the companies that make up the particular index, which gives you a more diverse portfolio than if you were buying individual stocks.

Warren is a strong advocate for index funds and is reported to have instructed that the managers of his estate should invest 90 percent of his funds (when he is no longer alive) into index funds.

His wealth creation principle is that you invest in an index fund and then take your eyes off the news headlines.

Invest and forget about it. The news can distract you or make you sell when market the swings occasionally – which is normal anyway. Don’t get carried away by the daily ups and downs that the media tend to emphasize.

“the best single thing you could have done on March 11th, 1942 – when I bought my first index fund – was to never look at the headline, (to) never think about the stock anymore. Just like you would do if you bought a farm” – Warren Buffett

He pointed out that if you had invested just $10,000 in index funds back then in 1942 and reinvested the dividends, without touching a cent of it. Basically forgetting about it. He said it would have yielded $51 million.

When you plant a crop, don’t uproot it now and then to see how the roots are growing. You let the tenant farmer run it for you. Warren applies the same principle to investing in index funds.

6. Don’t make investments unless you are psychologically prepared to hold them for long periods of time.

Warren Buffett’s wealth creation principle is playing for an extended period of time. It demands that you are financially and psychologically prepared for the difficulties that come with the long wait. He is known to hold on to some stocks for several decades.

He believes in the principle of buy and hold – not following the short-term market tide. Not doing daily trading your positions.

He says :

“I am not recommending that people buy stocks today, or tomorrow or next week or next month. I think it all depends on your circumstances but you shouldn’t buy stocks unless you expect in my view, to hold them for extended period and you are prepare pschologically and financially”

It requires a lot of patience. Which in this case will mean letting go of the idea of making money short-term. The stock market is volatile in the short-term but it has historically trended upwards.

All content on this site is based on my personal experience and reflects my own opinions. They should NOT be taken as financial, legal, or investment advice. Please seek the guidance of professionally trained and licensed individuals before making any decisions.

7 Money Myths That’ll Make You Think Twice